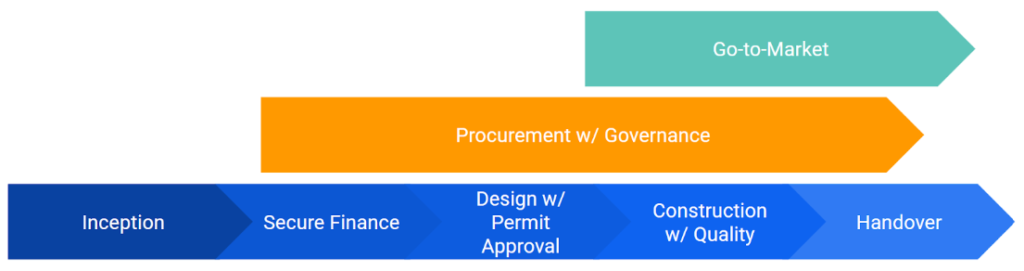

What is it like when doing a building development project?

Here’s a more detailed look at what it’s like for different phases of a Building Development Project:

Securing Finance Phase

There are different ways to finance your project. Some require more transparency and accountability than others. The interest rates are also different. Some involve inspections by the lender that can slow down the construction. There are different types of payment terms as well as draw-down conditions. There are also structured finance solutions used to pay for the construction and operation of projects, with debt repayment based on the project’s cash flow. Since obtaining necessary permits and approvals takes time, this may affect the type of financing to be taken for the building development project.

Regardless of which way to finance the project, it is important to manage the costs with tight monitoring and controlling the cost against the budget that was set. The budgeting is crucial, as construction costs can be unpredictable and subject to the changes in the inflation, economical, and political situations. Cashflow management is always the highest priority in managing the project.

It is also important to allocate a a contingency fund on top of the budget. A contingency fund will account for around 10% – 20% of the total project cost, to cover unexpected costs or changes during construction, including the inflation, disruption to the supply chain, as well as the sudden change in the national and the international government policies that impact the cross border trade. It’s better to be safe than sorry in these situations, and this can reduce any unnecessary financial strain should the unexpected arise.